According to the National Retail Federation, Black Friday is one of the busiest shopping days of the year. Over the five-day period from Black Friday through Cyber Monday, the average spending-per-person was $335.47 in 2017. The biggest spenders were older millennials (25-34 years old) at $419.52.

According to a 2017 National Retail Federation survey: “From Thanksgiving Day through Cyber Monday, more than 174 million Americans shopped in stores and online during the holiday weekend, beating the 164 million estimated shoppers from an earlier survey by the National Retail Federation and Prosper Insights & Analytics.”

Are you ready to spend that kind of money?

It’s been said that the only thing better than getting the perfect gift is giving the perfect gift. Holiday savings, like any savings goal, require a little guidance and lots of self-restraint. One tool to help with this is budgeting. Budgeting is a process of creating a plan to spend your money.

Here are a few tips that will make holiday savings easier and holiday spending savvier.

The Savings Mindset

This puts value on saving your disposable income over spending your disposable income. Saving can be difficult if you are trying to keep up with the societal norms of novelty over the practical benefit of the product.

Know The Goal – “If you don’t know where you’re going, any road will get you there” – Lewis Carroll. The plan should be specific, timely, and realistic: “I’d like to save $1,000 for gifts by November 15th.”

Acorns App – This is a spare-change and cash-back app that makes savings easier. Acorns accounts are easy to register and require only a $5 minimum deposit. This app can round up transactions on everyday spending and allows for weekly contributions. This will help take the “thinking” out of saving and is ideal for people who struggle to save, hands-off investors, and college students.

Stash the Cash – Create a savings account for the purpose of holiday gifts, or a box to keep $5 or $10 bills you collect throughout the year.

The Spending Mindset

This puts the value on spending your disposable income over saving your disposable income. Time is money, so know the value of your time as it relates to the cost of a gift. “This new jacket cost 30 hours of my time.”

Compare Prices – 80% of shoppers used a mobile phone inside of a physical store to either look up product reviews, compare prices, or find alternative store locations, according to an Outerbox article from September 4, 2018. To incentivize consumers, some brick-and-mortar stores will price match websites to better compete with the online marketplace. It can be as simple as asking the sales representative if they would price match the item you found online. Some of my favorite price comparison websites and apps are:

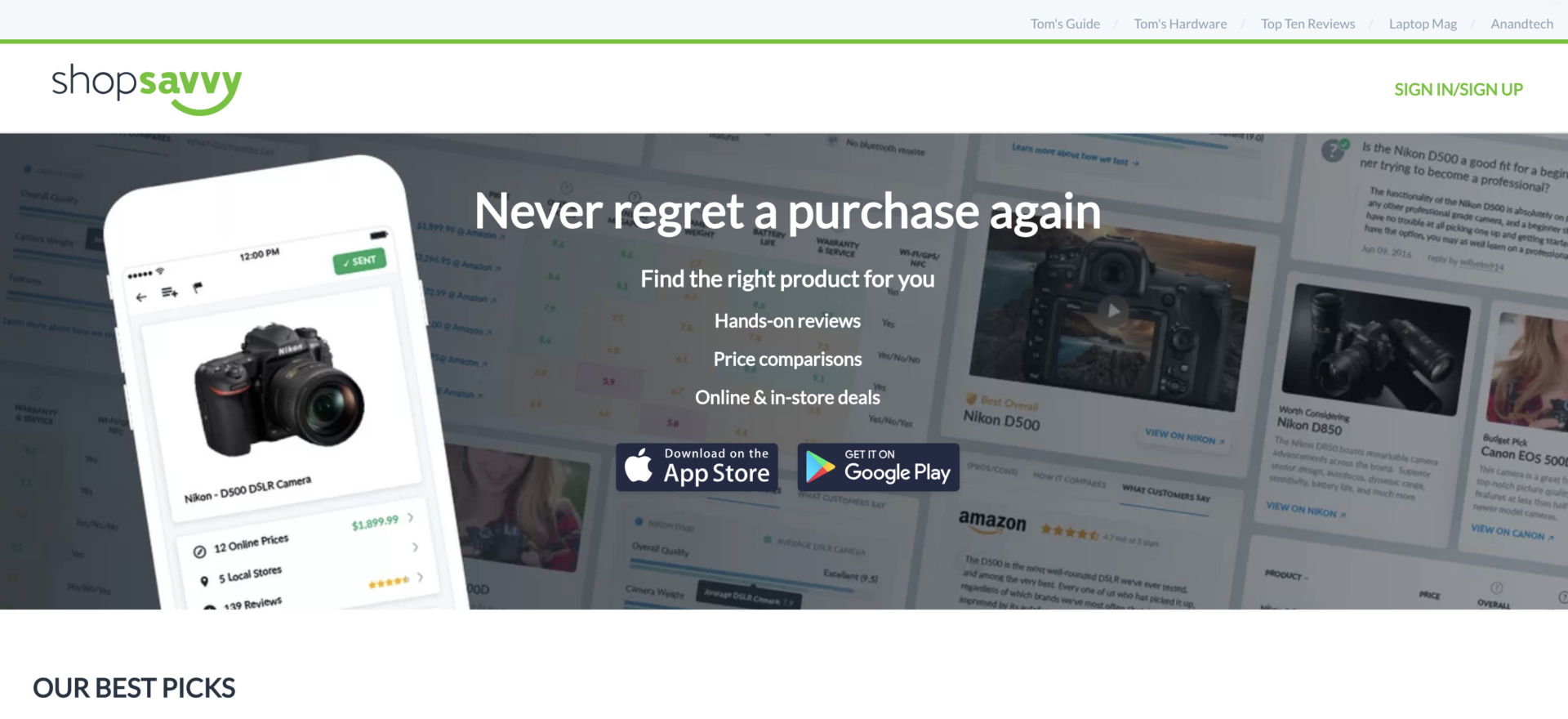

Shopsavvy App – This app allows you to scan barcodes in the store and see prices for online and in-stores.

BizRate.com – This user-friendly website allows customers to view and compare product prices and reviews. In addition, you can enter your email and a price threshold, and get notified when your specified product falls below your price point.

Promotional Codes – Promo Codes will help you save money by reducing the price of shipping or the cost of the product. Websites like retailmenot.com, allow you to search for any active or recently used codes. Printable and paper coupons are also available from the manufacturer (Nike) and the retailer (Dicks Sporting Goods).

Order Early – Shipping can get expensive the longer you wait to order a gift from an online retailer. Some stores like Lowes and Home Depot even offer free, in-store pickup.

My college Accounting Professor, Dr. William Hahn, would always say: “Proper planning prevents pathetically poor performance.” Given he would use this in reference to studying for a test, I have found ways to implement his advice into most areas of my life, including budgeting. By combining the saving and spending mindset, hopefully these hints can alleviate some of the holiday stress around purchasing gifts. If we can train our mind and behavior to align with our goals, we can meet them with less resistance and a little more change.